With the sunset of the Tax Cuts and Jobs Act (TCJA) looming, flexibility in estate planning has never been more critical.

Ironically, the old saying “the only certainties in life are death and taxes” doesn’t hold up when it comes to estate taxes right now. As we approach the end of 2025, many clients are left in limbo, unsure whether we’ll see a full sunset, an extension, or some sort of middle ground.

Rather than trying to predict what lawmakers will do, smart advisors are focused on keeping options open so clients can maintain control over their assets and planning—no matter the outcome. This comes down to three key pillars: trust language, policy ownership, and funding strategies.

The Role of Funding Strategies

In this environment, the focus remains on three main objectives:

- Preserving gifting capacity while it’s still available

- Avoiding unnecessary liquidation and the taxes that come with it

- Retaining maximum control over assets for as long as possible

For many, this means moving beyond traditional premium payments via annual exclusion gifts and considering financing strategies instead. While premium financing is often the first thing that comes to mind, there are multiple approaches, each with its own pros and cons:

- Private Financing

- Commercial Premium Finance

- The “Dual Loan” Approach

- Private Split Dollar

Among these, Private Financing and Private Split Dollar tend to provide the most control with fewer moving parts.

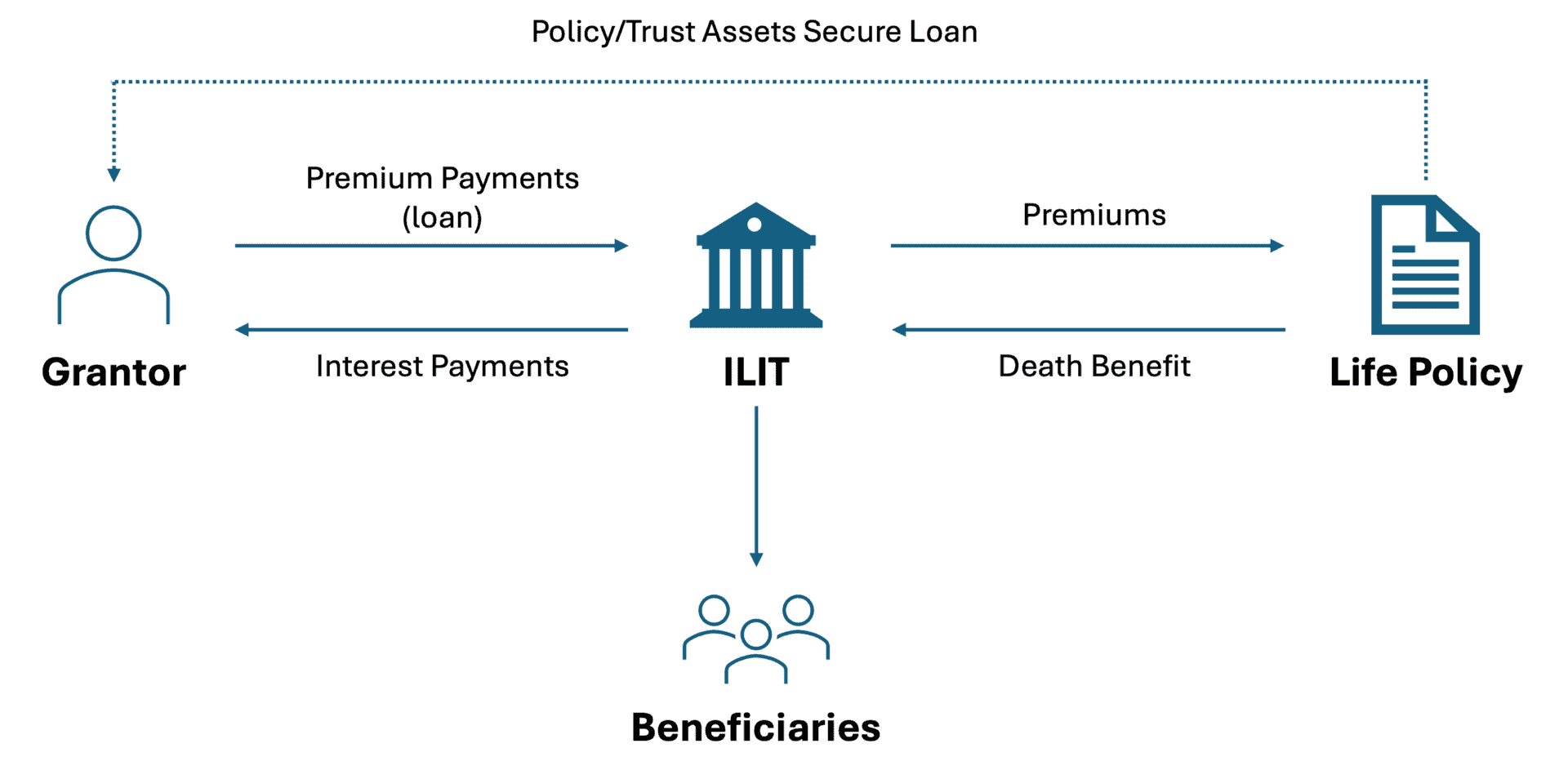

How Private Financing Works

- The grantor sets up an ILIT (Irrevocable Life Insurance Trust), which applies for and owns the policy.

- The grantor loans the trust the funds needed to pay premiums—often as a lump sum.

- The trust pays the premiums, and any extra funds can be invested or used for interest payments back to the grantor.

- The grantor has the option to forgive the loan at any point, turning it into a gift.

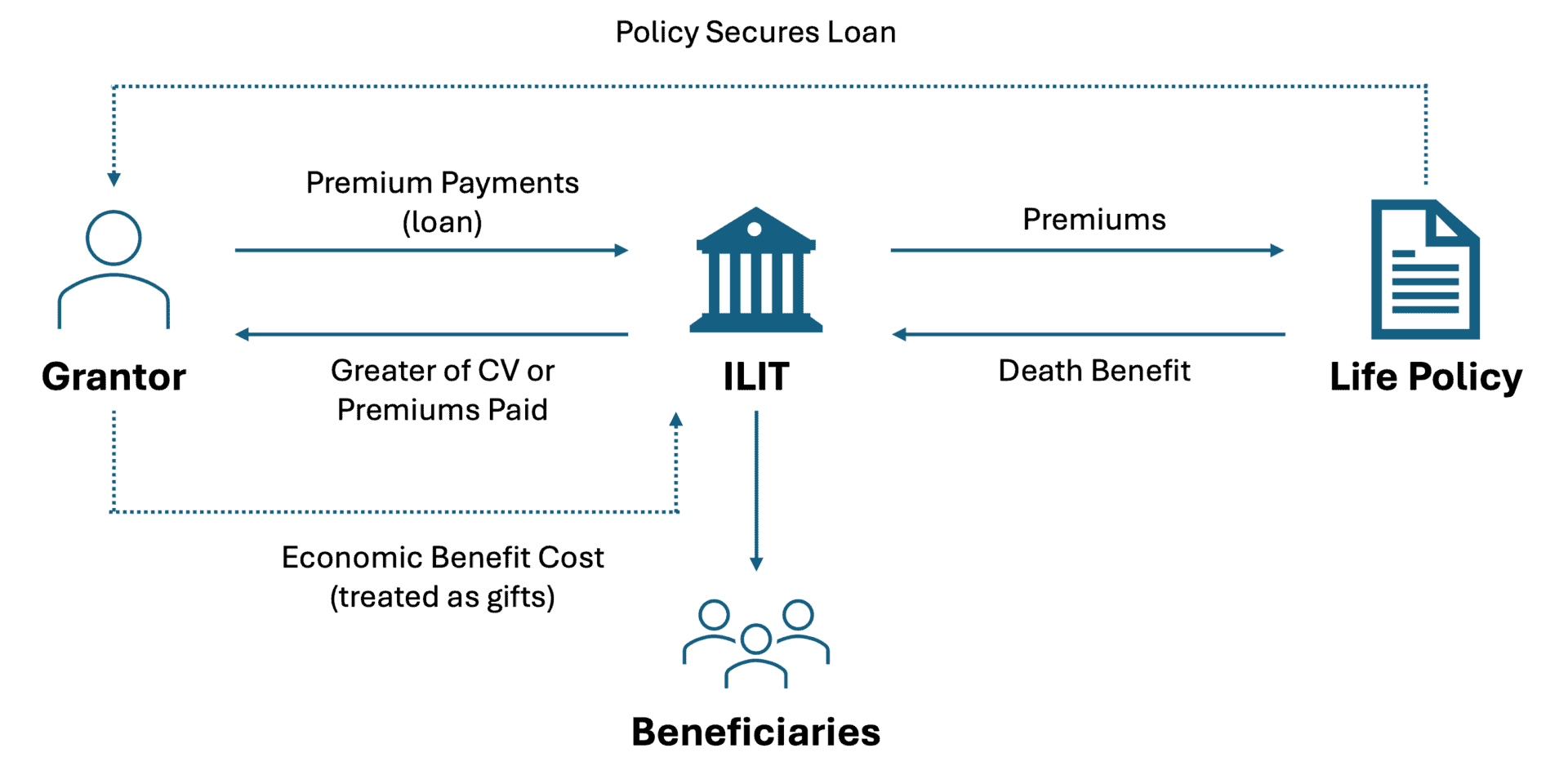

How Private Split Dollar Works

- The ILIT purchases a survivorship life insurance policy.

- The grantor advances premiums through a collateral assignment split dollar arrangement, usually on a limited pay schedule.

- These advances create a receivable owed to the grantor.

- The economic benefit cost is considered an annual exclusion gift.

- Like with private financing, the grantor can forgive the receivable, converting it into a gift.

Why These Strategies Make Sense Now

Both approaches offer the flexibility to transition a loan into a gift if the tax landscape shifts. With a limited window before potential estate tax changes take effect, Private Financing is often the most effective option—assuming there’s liquidity to fund the loan upfront. If liquidity is a concern, Private Split Dollar may be the better fit.

The Takeaway

Regardless of the strategy, it’s time to have these conversations with clients who may be facing new estate tax exposure due to the TCJA sunset. For some, this will be the first time estate tax liability is even on their radar. The educational process alone takes time—let alone implementation—so waiting until 2025 to act could mean missing the window for smart planning.

Now is the time to get ahead of it.