Introduction

Deciding where to stash your retirement savings can feel overwhelming. With options like the traditional 401(k) and the increasingly popular Cash Balance 401(k), it’s essential to understand the differences.

This guide will help you navigate the waters and decide if a Cash Balance 401(k) is right for you or your small business.

What is a Cash Balance 401(k) Pension Plan?

A Cash Balance Plan is a unique retirement savings vehicle. Imagine a pension plan with a twist. Instead of the traditional method, each participant has an individual account, much like a 401(k). Every year, two contributions are made:

- A “pay credit” which is a set percentage of the individual’s salary (DOL)

- An interest credit, either fixed or variable.

The beauty of this plan is its predictability. Market downturns? No worries; your retirement benefit remains more stable than with market-dependent options.

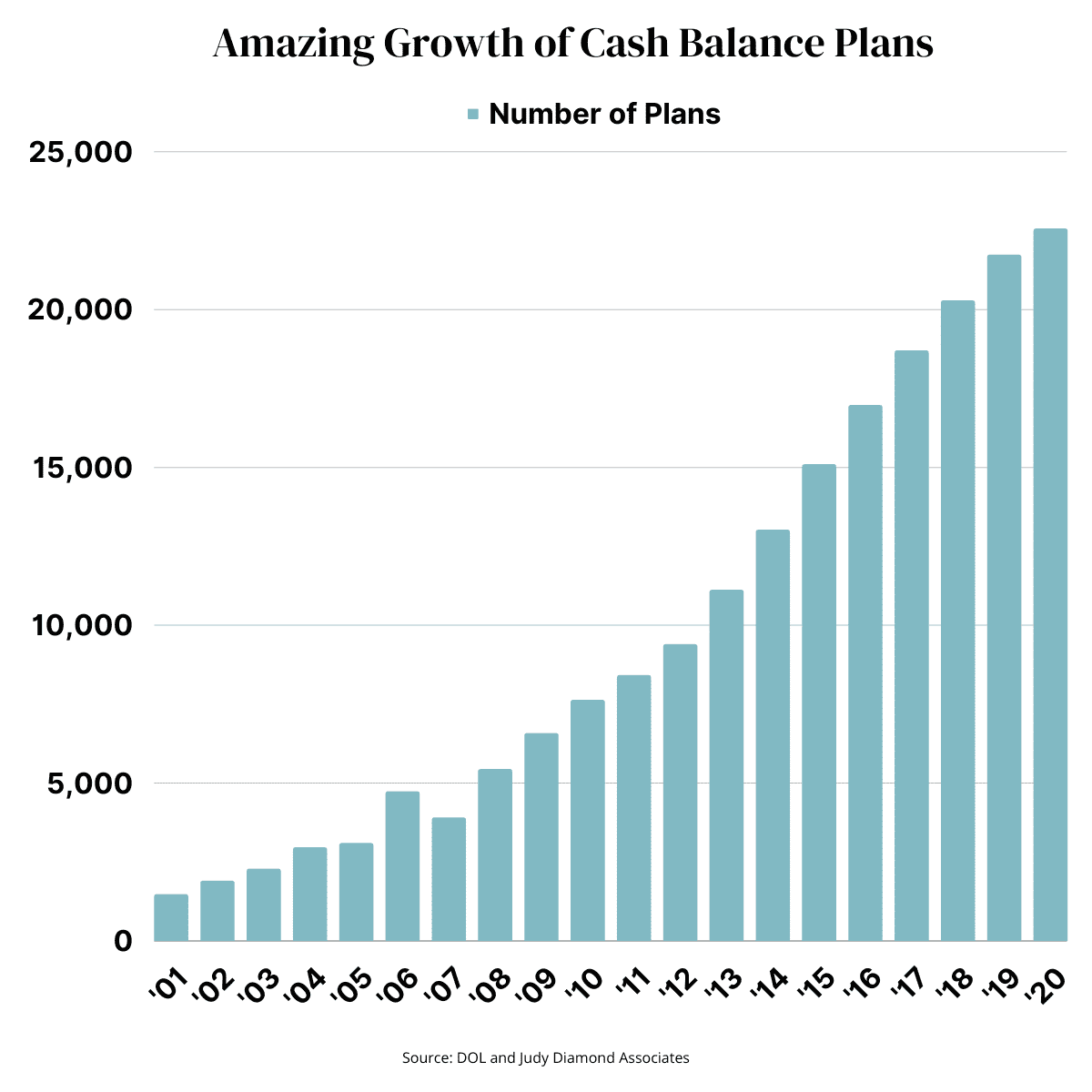

How Popular are Cash Balance Plans?

According to a national survey based on IRS Form 5500 Filings, Cash Balance Plans are now worth more than $1.2 TRILLION dollars, encompassing 9.4M plan participants (Future Plan)

In fact, the growth has moved from 1,477 plans nationwide in 2001 to 22,657 in 2020. According to the same study, Cash Balance Plans now make up 50% of all defined benefit plans, from 3% in 2001.

Cash Balance Plan vs 401(k): A Comparative Analysis

Both the Cash Balance Plan and the traditional 401(k) are retirement saving tools, but they cater to different needs and preferences. They differ in terms of contribution structure, predictability, and investment management. Below is an expanded discussion followed by a comparative table:

- Contribution Decisions:

- Traditional 401(k): Employees have the autonomy to decide how much they want to contribute from their paychecks. Typically, there’s an option for an employer to match up to a certain percentage.

- Cash Balance Plan: Contributions are defined by a formula, typically based on age, tenure, and salary. Employees don’t have a choice in determining the contribution amount. To maximize tax benefits for their top earners, businesses should allocate between 5% and 7.5% of worker salaries to a profit-sharing 401(k) that aids all staff members. – (Cash Balance Plans Gain in Popularity)

- Risk Assumption:

- Traditional 401(k): Investment risk is borne by the employee. The value of the 401(k) can fluctuate based on market conditions and investment choices.

- Cash Balance Plan: The employer assumes the investment risk. Even if the market underperforms, the promised benefit must still be delivered by the company.

- Predictability vs. Uncertainty:

- Traditional 401(k): The final value is uncertain as it depends on market performance and the effectiveness of investment choices.

- Cash Balance Plan: Offers a more predictable retirement benefit as it guarantees a specific balance upon retirement.

- Investment Choices:

- Traditional 401(k): Employees can choose where to invest from a range of options provided by the plan, which could include stocks, bonds, mutual funds, etc.

- Cash Balance Plan: The company manages investments, and participants don’t make individual investment decisions.

For entrepreneurs, making the right choice between these two options can significantly impact their financial stability, employee satisfaction, and business growth. Understanding these nuances becomes paramount.

Comparative Table: Cash Balance Plan vs. Traditional 401(k)

| Feature | Traditional 401(k) | Cash Balance Plan |

|---|---|---|

| Contribution Decisions | Employee decides the contribution amount. | Defined by a formula; not chosen by employee. |

| Risk Assumption | Borne by the employee. | Borne by the employer. |

| Predictability of Benefits | Depends on market performance. | Defined benefit; more predictable. |

| Investment Choices | Multiple options; chosen by the employee. | Managed by the company; no choice for employee. |

| Employer Contribution Matching | Often available up to a certain percentage. | Not applicable; fixed contributions based on formula. |

In conclusion, both the Cash Balance Plan and the traditional 401(k) offer unique advantages. The decision between them should be based on the business’s objectives, the financial needs of the employees, and the risk appetite of both the employer and the employee.

6 Key Advantages of Cash Balance 401(k) Plans

1. Higher Contribution Limits:

- Description: Cash balance plans often allow for much larger annual contributions than traditional 401(k) plans, especially for older participants. This enables wealthy entrepreneurs to build substantial retirement savings quickly.

- Benefit for Entrepreneurs: High-income business owners can take advantage of these elevated limits to rapidly grow their retirement nest egg, especially as they approach retirement age.

2. Tax Benefits:

- Description: Contributions to cash balance plans reduce taxable income, providing significant tax savings. The larger the contribution, the greater the tax benefit.

- Benefit for Entrepreneurs: Wealthy entrepreneurs, who are typically in higher tax brackets, can achieve substantial tax savings, helping them retain more of their income.

3. Predictable Retirement Benefits:

- Description: Unlike 401(k)s, which depend on investment performance, cash balance plans provide a predetermined retirement benefit. This can be based on a fixed or variable interest rate.

- Benefit for Entrepreneurs: Entrepreneurs can have peace of mind knowing exactly what their retirement benefit will be, reducing the uncertainty tied to market fluctuations.

4. Attract and Retain Talent:

- Description: Offering a cash balance plan can make a business more attractive to high-quality employees, especially when combined with a 401(k).

- Benefit for Entrepreneurs: By offering competitive retirement benefits, entrepreneurs can ensure they attract and retain the best talent, aiding in the success and growth of their business.

5. Flexible Design Options:

- Description: Cash balance plans can be designed to meet specific business needs. For instance, they can be structured to favor certain groups of employees (like older, higher-paid workers) without violating non-discrimination rules (Journal of Accountancy).

- Benefit for Entrepreneurs: Entrepreneurs can tailor the plan to align with their business objectives, whether it’s to benefit themselves, key employees, or a broader employee base.

6. Asset Protection:

- Description: Assets within cash balance plans are generally protected from creditors, ensuring that the funds set aside for retirement remain safe.

- Benefit for Entrepreneurs: Given that business owners might face risks from creditors or lawsuits, having a protected asset class like a cash balance plan can provide peace of mind and financial security.

These advantages underscore why cash balance plans can be a compelling option for entrepreneurs, especially those with high incomes seeking robust retirement solutions.

Who Benefits Most from Cash Balance Plans?

Cash balance plans are especially appealing to high-income professionals, self-employed individuals, and small business owners. If you’re looking for a cash balance plan for self-employed options or considering a solo cash balance plan, this might be the right fit. Business owners can also use this to attract talent, making the cash balance plan for small businesses a great choice. In fact, companies with nine or fewer employees are the sweet spot for these plans, making up over 60% of all plans nationwide (Future Plan)

Here are a few potential occupations that may want to look at a cash balance plan:

- Doctors and Medical Professionals: Surgeons, anesthesiologists, dentists, and other high-earning medical professionals often seek ways to put away more money for retirement, given their typically later start post-residency careers.

- Law Professionals: Partners in law firms, especially senior partners, who have substantial incomes can benefit from the higher contribution limits.

- Consultants: High-income consultants, especially those in sectors like IT, finance, and management, can benefit from the flexibility and contribution limits of cash balance plans.

- Architects: Successful architects, especially those running their own firms, might find cash balance plans appealing for tax deductions and retirement benefits.

- Real Estate Developers and Brokers: Given the variable nature of their income, having a structured retirement plan can be advantageous.

- Engineers: Especially those in specialized sectors with high incomes, such as petroleum engineers or senior software engineers.

- Financial Advisors and Planners: Given their understanding of financial products, they might be more inclined to see the benefits of such plans.

- Independent Contractors: Those in sectors like IT, where freelance or contract work is common and can be lucrative, might see the appeal, especially if they’re self-employed.

- Veterinarians: Especially those with their own practices or partnerships in larger clinics.

- Pharmacists: Especially those who own independent pharmacies.

- Entrepreneurs: Startup founders or those who have successfully scaled their businesses and have substantial personal incomes.

- Agency Owners: Individuals who own or run agencies in advertising, public relations, or marketing.

- Franchise Owners: Individuals who own multiple franchise units or have been successful in a particular franchise model.

- Accountants and CPAs: Especially those with their own firms or in partnership roles.

- E-commerce Business Owners: With the boom in online businesses, successful e-commerce entrepreneurs can benefit from structured retirement planning.

- Professional Athletes and Coaches: Given the typically shorter career span but high earning potential, structuring long-term financial security is crucial.

- Artists and Performers: Those in the entertainment industry with significant earnings, such as successful musicians, actors, or writers.

- Research Professionals: Individuals leading private research firms or those in high positions in research and development sectors.

- Educational Professionals: Such as university deans or professors in specialized fields with lucrative book deals or speaking engagements.

- Influencers and Content Creators: Those who have successfully monetized their platforms, especially on digital platforms like YouTube, Instagram, or TikTok.

These are just a few examples, but the key takeaway is that any high-earning professional, self-employed individual, or small business owner who wishes to maximize their retirement contributions and tax benefits should consider a cash balance plan.

Are there example cases?

Absolutely! We can use some of the public knowledge in this to show just how large some of these plans can become. The largest in the country is IBM with $56.8B in their plan, according to Judy Diamond Associates. The top 10 law firm balances range from $1.1B to $158.4M in plan assets.

Benefits of Integrating Life Insurance Into Cash Balance Plans

Cash balance plans, by themselves, offer a compelling retirement savings mechanism for many professionals. But when integrated with life insurance, they can provide even more profound benefits. Let’s delve into the advantages:

- Tax-Deferred Growth: One of the most significant advantages of using life insurance in a cash balance plan is the tax-deferred growth of the policy’s cash value. This means the money inside the policy can grow without being subject to annual taxation. Over the years, this can result in substantial compound growth, maximizing the amount available during retirement.

- Death Benefit Protection: Beyond the retirement benefits, the primary purpose of life insurance remains—providing a death benefit to beneficiaries. By integrating life insurance into a cash balance plan, professionals can ensure that their loved ones have financial protection in the event of their untimely demise.

- Flexibility in Distribution: Life insurance policies, when structured correctly, can offer flexible distribution options in retirement. Policyholders can access the cash value through tax-free policy loans, potentially providing tax-efficient retirement income.

- Diversification: Just as with any investment strategy, diversification is crucial. By adding life insurance to the mix of cash balance plan investment options, individuals can spread their risk and potentially enhance overall returns.

- Asset Protection: In many jurisdictions, life insurance policies are protected from creditors. This can be particularly advantageous for professionals in high-risk sectors who are more vulnerable to lawsuits.

- Legacy Planning: Life insurance can play a pivotal role in estate planning. For those who wish to leave a legacy, be it to family members, charitable organizations, or other beneficiaries, the death benefit from a life insurance policy can ensure those wishes are realized.

- Predictability and Stability: Unlike some volatile investment options, the cash value in life insurance policies, especially whole or indexed universal life policies, can offer more predictable and stable returns. This can be an attractive feature for those who are risk-averse or looking for more certainty in their retirement planning.

- Cost of Insurance: It’s essential to factor in the cost of insurance when considering life insurance as an investment. While there are undeniable benefits, the premiums, especially for policies with substantial death benefits, can be high. However, when weighed against the potential returns and other advantages, many find it a worthy consideration.

In conclusion, while cash balance plans alone offer a multitude of benefits, integrating life insurance can supercharge the potential advantages. As with any financial decision, it’s essential to consult with financial professionals to ensure that the strategy aligns with individual goals and circumstances.

Important Legal Aspects to Consider

Cash balance plans, though tremendously advantageous, come with a set of legal stipulations that sponsors and participants should be well aware of. Ensuring compliance not only safeguards the integrity of the plan but also helps in avoiding potential penalties and litigation. Here’s a deeper dive into the critical legal elements:

- Employee Retirement Income Security Act (ERISA):

- Overview: ERISA is a federal law designed to protect the retirement assets of Americans by implementing rules that qualified plans must follow to ensure that plan fiduciaries do not misuse plan assets.

- Implication for Cash Balance Plans: When setting up a cash balance plan, adherence to ERISA standards is crucial. This involves maintaining adequate funding, providing necessary disclosures to participants, and ensuring the right to claim benefits.

- Non-Discrimination Testing:

- Purpose: This test ensures that the benefits under the cash balance plan aren’t disproportionately in favor of highly compensated employees or key personnel.

- Implication: Regular testing is mandated, usually annually. Plans that fail this testing might need to make corrective distributions or contributions to remain compliant.

- Distribution Options and Restrictions:

- Understanding Options: Cash balance plans offer several distribution options, including lump-sum payments, annuities, or rollovers to another qualified plan. Each option may have its tax implications.

- Restrictions and Penalties: Early withdrawals, typically before age 59½, can attract penalties. It’s essential to understand when and how you can access funds to avoid unnecessary penalties and get the most out of the distribution phase.

- Plan Documentation and Reporting:

- Every cash balance plan must have a written document that details its operation and administration. This should include the formula for calculating contributions, benefits, eligibility criteria, and more.

- Regular reporting to the IRS and participants, using forms like the 5500 series, is mandatory.

- Plan Amendments and Termination:

- There may be instances where a business might want to amend or even terminate a plan. Proper procedures exist for both, and it’s crucial to follow ERISA guidelines in these scenarios to ensure seamless transitions or closures.

- Claims and Appeals Process:

- Plans are required to have a claims procedure in place. If a claim for benefits is denied, ERISA mandates that participants must receive a written notice detailing the reasons for the denial and have the right to appeal the decision.

- Fiduciary Responsibilities:

- Plan sponsors and fiduciaries must act in the best interests of participants. This means prudently managing plan assets, monitoring service providers, and ensuring that fees are reasonable.

In summary, while cash balance plans are a potent tool for retirement savings, it’s imperative that businesses and individuals are aware of the legal landscape surrounding them. Regular consultation with legal and financial professionals is highly advised to ensure that the plan remains compliant and continues to serve the best interests of all participants.

What are the cash balance pension plan investment options?

In a cash balance pension plan, the investment options and decisions are typically the responsibility of the employer or the plan sponsor, rather than the individual participants. This differs from defined contribution plans, such as 401(k)s, where participants usually choose their investments from a range of options provided by the plan.

Here’s a breakdown of the investment approach in cash balance pension plans:

- Employer-Controlled Investments: The employer or plan sponsor usually selects the investments for the cash balance plan, often in consultation with financial advisors or investment managers. They will determine the asset allocation, which may include a mix of stocks, bonds, mutual funds, and other investment vehicles.

- Interest Crediting Rate: Instead of reflecting actual investment returns, participant accounts in a cash balance plan receive an interest credit. This rate can be fixed (e.g., 5% annually) or variable, often tied to a known index like the 30-year Treasury bond rate. The specific interest crediting rate is defined in the plan document.

- Protection from Market Volatility: One of the features of cash balance plans is that participants are insulated from market downturns. If the plan’s actual investments underperform the promised interest crediting rate, the employer bears the responsibility to make up the difference.

- Potential for Overfunding: On the flip side, if the plan’s investments perform better than the promised rate, the plan could become overfunded. Depending on plan provisions and other factors, excess funds might be used to offset future employer contributions or to enhance participant benefits.

- Plan Restrictions: The investment strategy for a cash balance plan must align with ERISA requirements, which emphasize diversified investments to minimize the risk of large losses. Additionally, certain investments may be restricted to ensure the plan can meet its obligations.

While participants in cash balance plans don’t have the flexibility to select individual investment options as they would in a defined contribution plan, they benefit from predictable growth in their accounts without the direct impact of market volatility. However, it’s essential for employers to manage the investments prudently, given the promises made to participants and the financial obligations of the plan.

Cash Balance Plan Disadvantages

Indeed, for all the benefits they offer, cash balance plans aren’t free from drawbacks. Here’s an in-depth look at some of the challenges and disadvantages:

- Complexity of Setup and Management:

- Details: Establishing a cash balance plan often involves intricate calculations based on actuarial estimates. This goes beyond the simple percentage-based contributions typical of other retirement plans.

- Implications: Such complexity often necessitates hiring specialized consultants or firms, adding to the initial setup cost. Additionally, ongoing management requires regular review of actuarial assumptions and potential adjustments to funding.

- Mandatory Contribution Requirements:

- Rigidity: Unlike profit-sharing or 401(k) plans, where contributions can vary based on business profitability, cash balance plans mandate fixed contributions.

- Financial Strain: In lean years, these mandatory contributions can put a significant financial burden on the business. This can be particularly challenging for businesses with fluctuating revenues.

- Accessing Funds:

- Limited Liquidity: Participants might find that accessing funds from a cash balance plan isn’t as straightforward as with a traditional 401(k). Typically, funds in cash balance plans are designed to be accessed upon retirement or termination of employment.

- Early Withdrawal Penalties: Just like many retirement plans, taking money out before a certain age can result in substantial tax penalties.

- Cost Implications:

- Beyond mandatory contributions, businesses need to factor in the costs of plan administration, actuarial services, and possibly more frequent compliance testing. These costs can quickly add up, especially for smaller businesses.

- Vesting Schedules:

- Some cash balance plans may have slower vesting schedules, which can be a deterrent for newer employees. They might have to stay with the company for several years before they’re fully vested in their accrued benefits.

- Investment Risk:

- While these plans generally shift the investment risk from the employee to the employer, it’s the business that bears the brunt of poor market performance. If investments underperform, the business might need to contribute more to make up for the shortfall. Interested in something that doesn’t have an inherent investment risk, and allows for greater contributions? Check out a Restricted Property Trust

- Communication Challenges:

- Given their unique structure, cash balance plans might be harder for employees to understand compared to traditional 401(k) plans. Employers might face challenges in effectively communicating the benefits and mechanics of the plan.

In sum, while cash balance plans can be an excellent tool for retirement savings, especially for specific demographics, they come with their own set of challenges. Businesses and professionals should weigh these disadvantages against the potential benefits before implementing such a plan.

Conclusion

When considering retirement options, the Cash Balance 401(k) stands out for many high earners and business owners. Weigh the cash balance plan pros and cons, check out a cash balance plan illustration to get a clearer picture, and remember to consider factors like cash balance plan lifetime limits. It might be the retirement solution you’ve been searching for!